STANDARDS, REGULATION &

PROFESSIONAL CONDUCT

Eric Wong graduated from the QP in 2007 and is Associate Director of an asset management company.

The Institute plays a crucial role in safeguarding a high quality of financial reporting by companies based or listed in Hong Kong. This helps to maintain the city’s leading position as an international financial centre. As the body responsible for setting accounting, auditing and ethics standards in Hong Kong, the Institute is committed to full convergence with international standards. Not only does the Institute shape international standards to work for Hong Kong, from the development stage to successful implementation, its activities in quality assurance and compliance ensure that accountants follow these standards.

DEVELOPING EFFECTIVE STANDARDS THROUGH COMPREHENSIVE RESEARCH

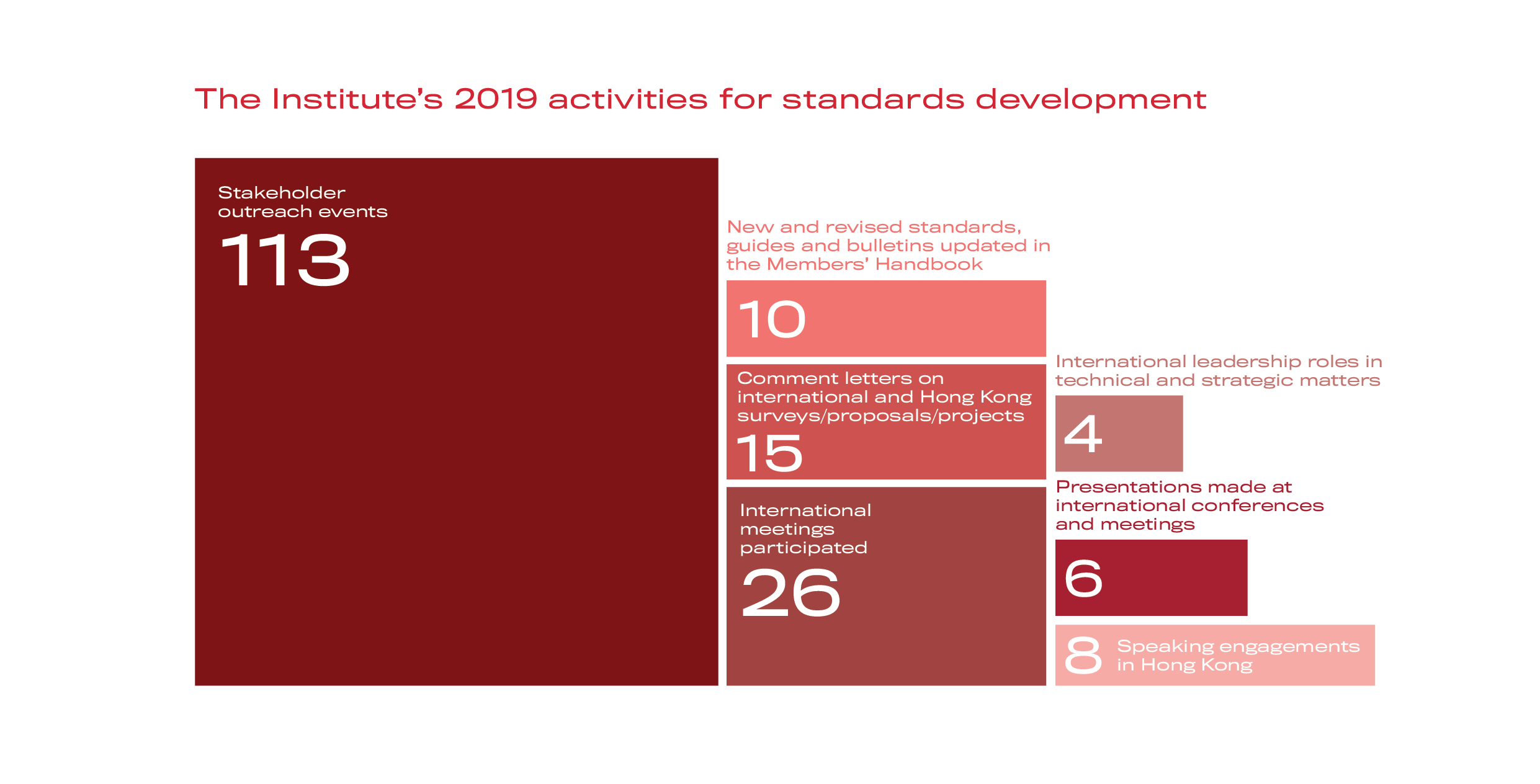

During the year, the Institute closely collaborated with international standard-setting bodies, including the International Accounting Standards Board (IASB), the International Auditing and Assurance Standards Board (IAASB), the International Ethics Standards Board for Accountants (IESBA) and various national standard-setters. The Institute’s active involvement at the development stage of international standards ensures that its views, and the views and concerns of its stakeholders, are effectively expressed and considered on the global stage.

We were invited by the Accounting Standards Committee of Germany to participate in its 20th anniversary event, and also by the Board of the European Financial Reporting Advisory Group to present and discuss the Institute’s standard-setting activities and topical reporting concerns.

We continued our collaboration project with the Italian standard setter, the Organismo Italiano di Contabilità, to develop sound principles for the accounting of business combinations under common control, and worked with the Canadian Accounting Standards Board and the Korea Accounting Standards Board to drive global discussions on International Financial Reporting Standard (IFRS) 17 Insurance Contractss implementation developments. This year, we commenced a joint research project with the Accounting Standards Board of Japan to investigate better ways to account for goodwill. We also continued in our leading role in the activities of the Asian-Oceanian Standard-Setters Group (AOSSG), and also participated in various other standard-setters meetings.

The Institute supports and advises Alden Leung, who was appointed to the IESBA Board from January 2018, on technical and strategic board activities. The Institute also continues to represent the AOSSG at the IASB’s Accounting Standards Advisory Forum on technical topics, such as business combinations under common control and revenue.

Back in Hong Kong, the Institute conducted a major review of its home-grown Small- and Medium-Sized Entity Financial Reporting Framework and Financial Reporting Standard to ensure that the standard and framework are still fit for purpose. To do so, we reached out to small- and medium-sized entities and practitioners (SMEs and SMPs), and key users of SME financial reports. In addition, the Institute published its Second Year Review of Enhanced Auditor’s Reports, comprising findings from its ongoing study on the quality of the new long-form audit reports and whether they add value to users of financial reports.

“In addition to technical knowledge, the QP has provided me with the right ethical mindset to carry out my professional work,” says Wong, who is also a QP facilitator for Module A – Financial Reporting.

EDUCATING STAKEHOLDERS

The Institute also plays a vital role in bridging in-person dialogue between our stakeholders and the IASB, the IAASB and the IESBA, ensuring their views are effectively expressed. We worked with these boards and brought together Hong Kong investors, senior executives and accountants of financial and corporate entities of all sizes, auditors, technical advisors and regulators, by way of roundtables, to discuss topical concerns and auditing or reporting challenges.

Another important part of standard-setting is the Institute’s role in educating the wider Hong Kong reporting stakeholders. We continued to meet with and inform investors and regulatory and governmental bodies about the impact of new financial reporting and auditing and assurance standards, and how they could benefit from them.

Apart from setting standards, the Institute has been vocal about the need to strengthen the business valuation quality in Hong Kong given the prevalence of “fair values” in financial reporting. Accordingly, along with other targeted key stakeholders, we actively participated in a local working group that aims to establish a professional valuation framework to help elevate standards and professionalism in valuations for Hong Kong. This working group is in collaboration with, and facilitated by, the International Valuation Standards Council.

SUPPORTING THE APPLICATION AND IMPLEMENTATION OF STANDARDS

Our technical resources webpage is regularly updated to ensure members have convenient access to all technical information in one place. Through our LinkedIn showcase page, weekly e-circular and monthly TechWatch bulletin, the Institute is committed to an open communication with members and other stakeholders. Additionally, we made sure that challenges in implementing standards are addressed through expert group discussions, training and Q&A publications, and that standards are communicated to members and the public in an informative and timely manner through public forums and articles published in our official monthly magazine, A Plus.

Strengthening members’ core skills is a key priority of the Institute, and to help achieve this goal the Institute organizes a range of technical events, courses and access to a range of online resources – more details of which can be found in Chapter 4 Member Services, Development and Events.

QUALITY ASSURANCE

Through two quality assurance programmes, practice review and professional standards monitoring, the Institute is able to enhance, monitor and maintain public trust in the quality of work conducted by our members.

Prior to October 2018, the Institute’s practice review programme consisted of inspections and reviews of audit practices in Hong Kong. By applying international best practices, the programme gives priority to reviewing practices with listed company clients. In October 2018, the Institute launched a new anti-money laundering and counter-terrorist financing (AML) compliance monitoring programme which covers all practice units – including those previously exempted from practice reviews due to non-performance of audits.

Since then, the Institute has included an AML review in its practice reviews of audit practices, and arranged a separate AML review for those practices which do not provide audit services.

During the reporting period, 216 site visits and 104 desktop reviews were carried out by Institute staff, while the Practice Review Committee (PRC) considered 342 reports. While this demonstrates the dedication and effectiveness of the programme, the Institute’s three-year plan to shorten the practice review cycle for practices without listed clients to six years had still not been achieved. However, the goal remains and the Institute intends to achieve it as soon as resources permit.

Where deficiencies are identified, the PRC exercises appropriate responses. Depending on the severity of the issues, the PRC can direct firms to implement remedial action, require additional site visits be scheduled, or raise complaints against practices. A total of 19 cases were referred for disciplinary action, while two other cases concerning the audits of listed companies were referred to the Financial Reporting Council (FRC) for further investigation.

The Institute referred a number of cross-border engagements to the Supervision and Inspection Bureau of the Chinese Ministry of Finance for review under our memorandum of understanding.

The Quality Assurance Department and the PRC monitored existing practice review outcomes and, to enhance effectiveness, introduced new elements and procedures to the practice review programme.

Following on from the passing of the Financial Reporting Council (Amendment) Ordinance in early 2019, the practice review responsibilities for auditors of public interest entities completed after 1 October 2019 has transferred to the FRC. The Institute has liaised with the FRC about the transitional arrangements, and will continue to do so in the future. The Institute has made announcements about the changes to its members.

Although its role is changing, the Institute will continue to visit all practice units, where practice reviews will focus on the regulation of non-listed audits and AML compliance monitoring.

The second review system is the professional standards monitoring programme, which involves reviewing published financial statements of Hong Kong’s listed companies, including those of H-share companies audited by Mainland audit firms. A total of 58 sets of financial statements were reviewed during the year, and 12 letters were sent to auditors with recommended revisions and improvements. Findings from both programmes were published in the annual Quality Assurance Report and communicated to members and stakeholders via articles and technical education events.

COMPLIANCE

In the midst of a global focus on audit quality, the Institute is committed to upholding the integrity of the profession through effective and efficient complaint handling. To promote proficiency, the Compliance Department also organizes technical forums and publishes articles in A Plus to alert members of contemporary regulatory issues and to promote good practices. Furthermore, the department’s 2018 Annual Report publicized the Institute’s compliance and enforcement activities.

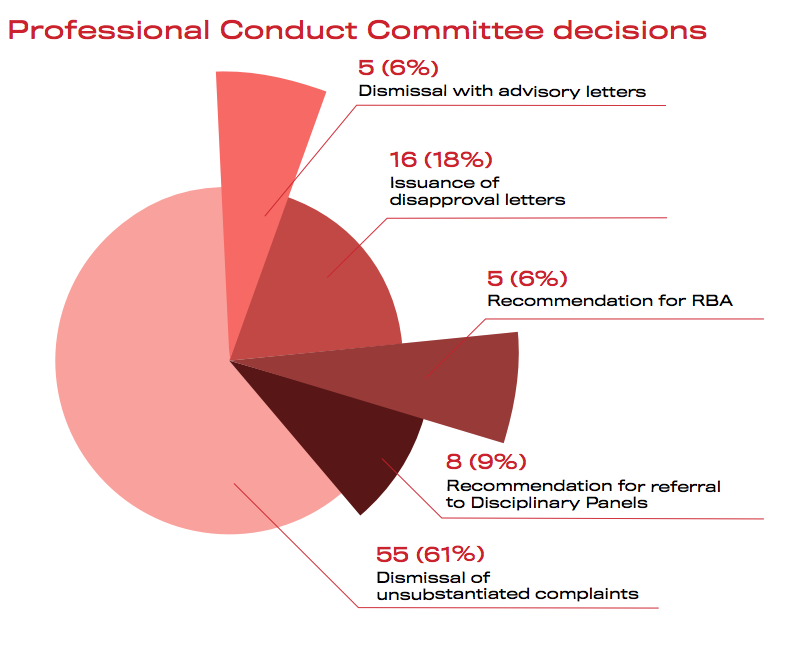

Every complaint received by the Compliance Department is investigated in accordance with an established complaint handling system. Cases are reported to the Professional Conduct Committee (PCC), or considered by an Investigation Committee (IC), for further evaluation.

The PCC has the power delegated by Council to dismiss unsubstantiated complaints and adjudicate minor ones by issuing private reprimands known as disapproval letters.

The PCC and IC refer more serious complaints to the Council for determination of appropriate actions. For moderately serious complaints that meet a set of pre-determined criteria, the PCC may recommend resolving it by Resolution by Agreement (RBA) in lieu of formal disciplinary proceedings. For serious complaints, the cases may be referred to the Disciplinary Panels for determination by independent Disciplinary Committees (DCs). All RBAs and disciplinary orders are published in A Plus and on the Institute’s website to ensure transparency of the enforcement process.

During the reporting period, 101 new complaints were received, bringing the caseload during the year to 130. The PCC considered 89 cases and approved the following outcomes:

During the period, Council considered recommendations from the PCC and approved seven RBA cases. Six were accepted by respondents and concluded during this reporting period, including one which was pending acceptance by respondents at the beginning of the period. Two cases were pending acceptance by respondents at the end of the period.

To protect the public, the Institute took action against companies or individuals who fraudulently held themselves out as firms of CPAs or offered to provide services that only practising CPAs are qualified to provide. Five cases were reported to the police during the period.

ENFORCEMENT

At the beginning of the reporting period, the Enforcement division was established under the Legal Department, with overall responsibility for prosecutions, to ensure the effectiveness of the disciplinary process while lowering costs.

Council will determine whether complaints referred from the PCC, PRC and ICs of the Institute require disciplinary action.

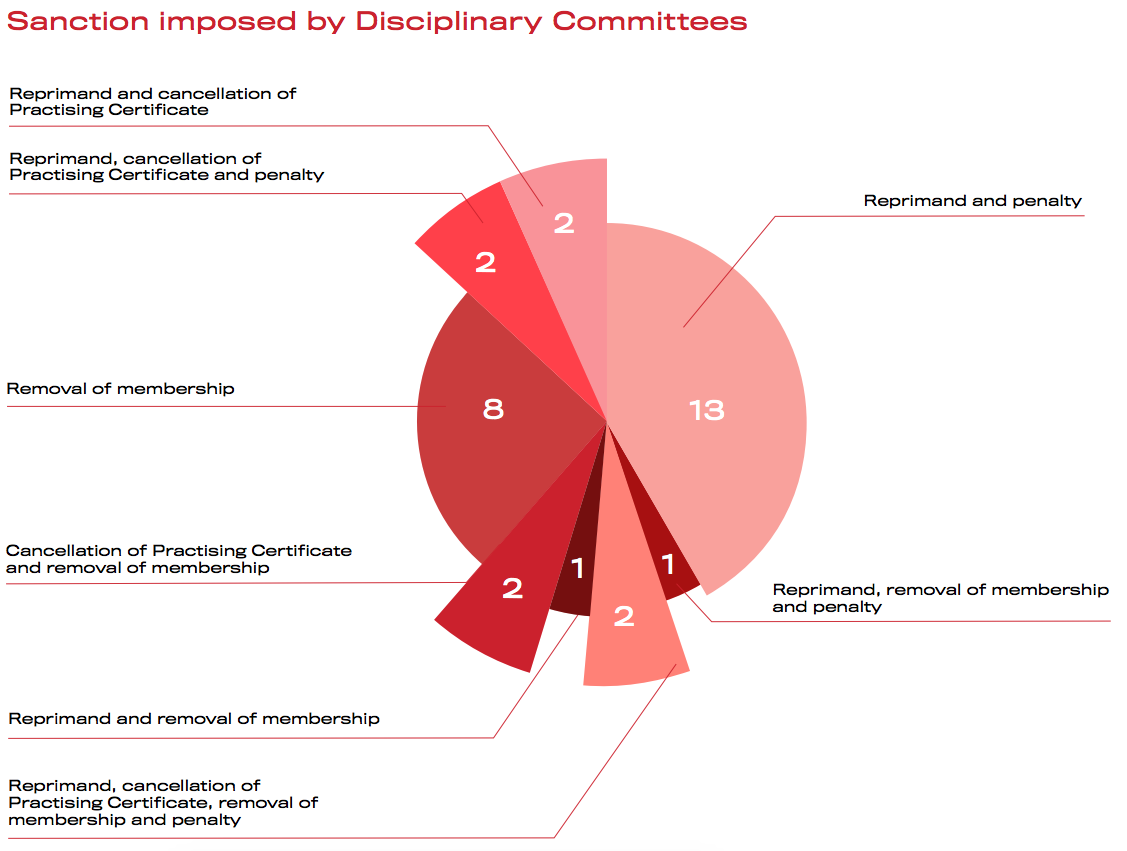

During the reporting period, the Enforcement division handled prosecutions of 60 disciplinary cases referred by the Council for determination by the independent DCs. At the beginning of the reporting period, 37 disciplinary cases were in progress and Council referred another 23 cases. A total of 31 disciplinary orders were issued by DCs and their outcomes are summarized below.

Disciplinary orders are published in A Plus and on the Institute’s website in accordance with the Institute’s publication policy.