MAINLAND

& INTERNATIONAL

Loretta Chiu is an Associate Director at asset management company Barings (U.K.) Limited in London.

The international experience of Hong Kong CPAs shapes the profession. It is what allows them to play a vital role in running and advising a wide range of global organizations. Our members are also highly regarded and relied on for their Greater China expertise. Through ongoing communication with Mainland authorities and regulators, the Institute focuses on helping members stay on top of developments, and ensuring that their views are heard and addressed.

Our presence in the Mainland and international forums strengthens Hong Kong’s role as an international business and financial centre, and in connecting the Greater China market on a global scale.

In November 2018, the Institute joined the annual Cross-straits, Hong Kong and Macau Accounting Profession Conference. Held in Macau, the conference covered developments in international auditing standards, and the impact of new tools on auditing methods. The conference also discussed the Greater Bay Area (GBA), and the development of the accounting industry.

THE MAINLAND

Creating business opportunities in the Greater Bay Area

The development of the GBA initiative is one of China’s key national strategies for its continued prosperity. The unveiling of the official blueprint for the GBA, the Outline Development Plan, in February 2019 was a critical milestone of the initiative. Governments, professional bodies, industries, and business communities are proactively responding to the plan to take forward the development of the GBA for the betterment of the society. The Institute, with its membership covering a wide spectrum of interests and sectors, has the position and ability to bring together various stakeholders and is well placed to help the accounting profession to explore opportunities in the GBA.

With many of our members working across the border and others engaged in cross-border business, the Institute’s priority is to effectively support them by working closely with Mainland authorities and accounting bodies. The Institute continues to provide a wish list and input to the Mainland and Hong Kong Closer Economic Partnership Arrangement (CEPA) initiatives, and liaised with relevant authorities including the Hong Kong government to resolve issues relating to the implementation of CEPA measures.

The expanded Guangdong-Hong Kong-Macau CPA Practices Alliance welcomed eight Macau CPA practices in late 2018, making it a professional network of over 60 CPA firms in the GBA. The first meeting of the expanded alliance was held in December 2018 in Guangzhou. Around 100 representatives met to welcome the Macau CPA practices, followed by a talk on the China-United States trade war.

A regular gathering of the alliance was held in Guangzhou in June 2019. Nearly 30 Hong Kong delegates were joined by over 120 of their Guangdong and Macau counterparts at the meeting, which featured a seminar on the digital economy and building the GBA, a roundtable experience sharing and discussion on further collaboration between the firms.

The Institute also organized and joined a number of other activities in the Mainland.

In April, the Institute renewed the QP Resource Centre contract with the United International College (UIC), jointly founded by Beijing Normal University and Hong Kong Baptist University, and hosted a high-table dinner where the Institute President delivered a speech on “CPAs for GBA” inspiring the UIC students to be Accountants Plus in the digital era.

In June, the Institute joined a GBA task force, led by the Hong Kong Coalition of Professional Services, working closely with Guangzhou Tianhe District to jointly promote modern service industry. A series of events and match-making activities will be organized in the second half of the year for members to attend.

“As part of my current role, I’m always communicating with different parties, and I have to be detail-oriented and stay organized. The QP training was priceless in preparing me for this. After I qualified and became an external auditor, I was able to apply my project management skills and deal with pressure while still getting the work done,” says Chiu.

Fostering productive relationships with Mainland partners

Throughout the year, we undertook various efforts in order to maintain good relationships with Mainland regulators.

In November 2018, the Institute met with representatives from Guangzhou Municipal Commission of Commerce to explore potential collaboration opportunities.

Representatives from Shenzhen Luohu District Investment Promotion Bureau visited the Institute in January to discuss how to strengthen exchange and cooperation of accounting professional services and modern service industry between Hong Kong and Shenzhen under the GBA initiative.

Also in January, the Institute’s Council representatives met with Tan Tieniu, Deputy Director of the Central People’s Government’s Liaison Office in the Hong Kong SAR, and exchanged views on the development of the Hong Kong accounting profession.

In March, the leadership also received a 10-person delegation from the Beijing Institute of Certified Public Accountants (BICPA) and signed a memorandum of understanding to jointly provide continuing professional development and other training courses to BICPA members.

In April, we welcomed representatives from the Ministry of Finance (MoF) and gathered MoF-appointed Accounting Advisors to discuss the amendments to the “Law of the PRC on Certified Public Accountants” as well as sharing updates on the implementation of IFRS 16 Leases.

In June, the Institute’s leadership, along with key management visited the MoF, the Chinese Institute of Certified Public Accountants, the China Securities Regulatory Commission to exchange views on the latest industry developments and update each other on recent regulatory changes and trends.

Also in June, representatives of the Institute’s China Tax Subcommittee held its eighth annual meeting with the State Taxation Administration (STA) in Beijing in June, where issues relating to Mainland and cross-border taxation affecting Hong Kong were discussed. Minutes of the eighth meeting have been published on the Institute’s website.

In December 2018, China Tax Subcommittee representatives held annual liaison meetings on technical matters with the STA’s Guangdong Provincial Tax Service and Shenzhen Tax Service. The minutes of these meetings have been published on the Institute’s website.

The Restructuring and Insolvency Faculty Executive Committee (RIFEC) Chairman, Terry Kan, participated in the 10th PRC Bankruptcy Law Forum, the largest bankruptcy law forum held in the Mainland annually, in June 2019. The event was organized by Renmin University of China Law School, Guangxi Higher People’s Court and China Council for the Promotion of International Trade and Beijing Bankruptcy Law Society. Over 400 judges from Mainland bankruptcy courts, insolvency practitioners and academics attended the forum.

INTERNATIONAL

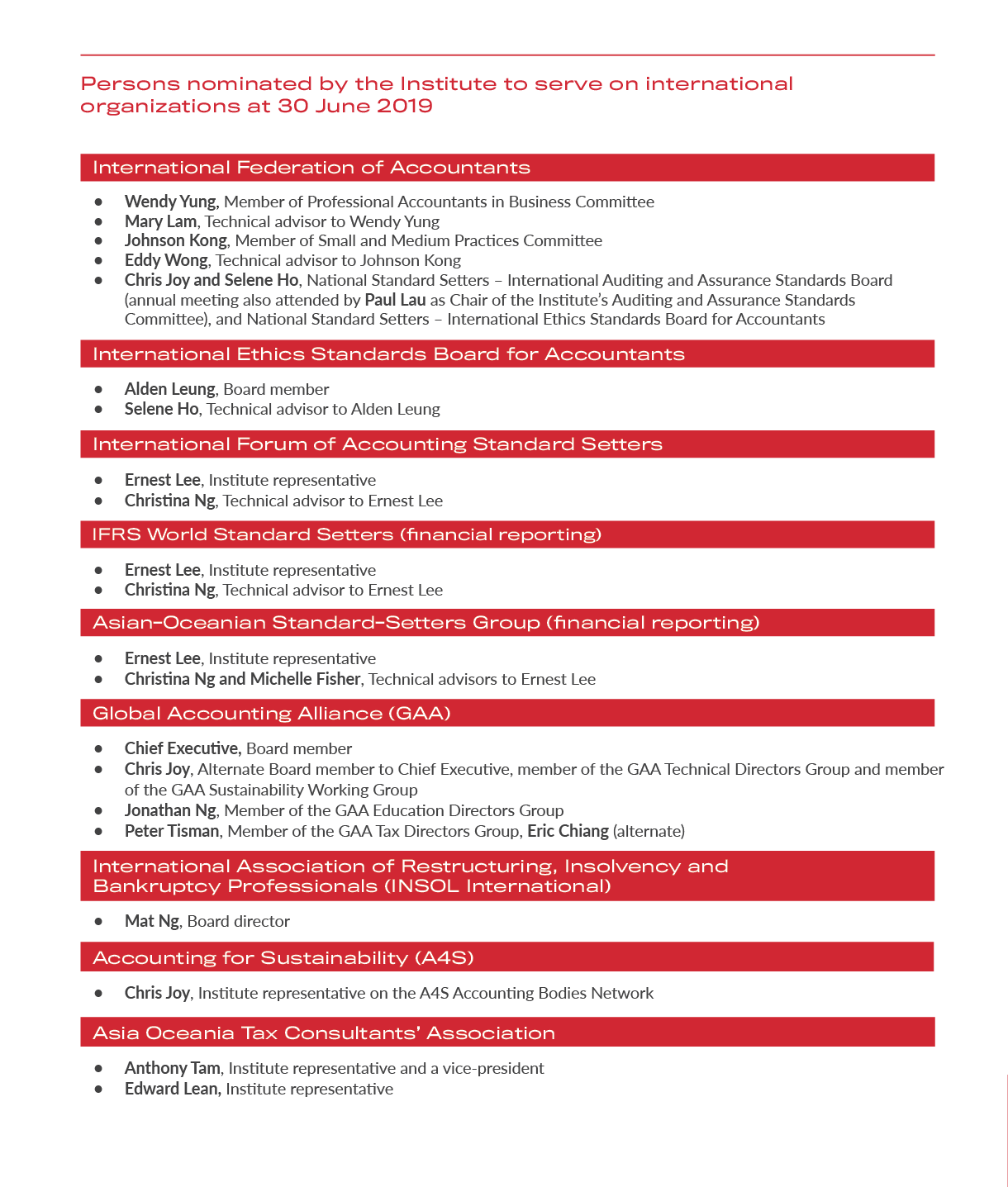

The Institute plays a leading role in a range of international accounting bodies. Through meetings, forums and seminars, the Institute represents the Hong Kong profession on a global stage and ensures its views are taken into account.

The Institute provides technical support to its representatives on the International Federation of Accountants (IFAC) Professional Accountants in Business Committee (Wendy Yung) and Small and Medium Practices Committee (Johnson Kong), facilitating their participation in various IFAC projects and working groups or task forces.

The Global Accounting Alliance’s (GAA) Tax Directors Group, established by the board of the GAA in 2009 to share information and best practice on tax matters, to network, and discuss and collaborate on important international issues and solutions to common concerns, held two face-to-face meetings during the year. One in Brussels in November 2018, attended by the Deputy Director, Advocacy and Practice Development, and the other in Hong Kong and Beijing in April 2019, which the Institute hosted. The Hong Kong meeting included a number of briefing sessions on current issues in Hong Kong and Mainland tax, the legislative process in a meeting with the accountancy functional constituency representative, and the Belt and Road and GBA initiatives. The tax directors from the United States, United Kingdom and Ireland also spoke at a seminar, giving updates on U.S. tax reform and Brexit. To promote the role of the GAA to the Institute’s members, a roundtable was organized for A Plus to report the views of the directors on key global tax developments.

Institute representatives participated in the Asia Oceania Tax Consultants’ Association’s (AOTCA) annual meeting and tax conference in October 2018. During the period, two Institute representatives (2017 Taxation Faculty Executive Committee chair, Anthony Tam, and member, Edward Lean) served as technical advisors on AOTCA’s Technical Committee.

As one of the 10 largest member associations, the Institute holds a directorship on the board of INSOL International, the international body for restructuring and insolvency professionals. The then RIFEC chair, Mat Ng, was nominated for a three-year term, commencing October 2016. His successor has been announced as Terry Kan, the current RIFEC Chair.

INSOL held a one-day conference in Hong Kong in November 2018, supported by the Institute, and followed this with a board meeting. In view of the success of the Hong Kong event, INSOL held another well-attended one-day seminar in Hong Kong in October 2019.

INSOL’s 2019 Annual Regional Conference was held in Singapore in April 2019. In conjunction with this, INSOL organized a one-day meeting for representatives of member associations, in which the Director, Advocacy and Practice Development participated on behalf of the Institute.