THOUGHT

LEADERSHIP

Andy Chan is Asia Pacific Head of Tax and Treasury at a luxury fashion house, as well as an Authorized Supervisor. He graduated from the QP in 2005.

From contributing its expertise on matters of policy, to advocating for a diversified and strong economy, the Institute is dedicated to championing thought leadership for the betterment of the profession and Hong Kong.

SUPPORTING THE ANTI-MONEY LAUNDERING REGIME

Enhancing the regime

The Institute worked closely with the Financial Services and the Treasury Bureau and the Narcotics Division of the Security Bureau, as well as representatives from member practices, to prepare for the mutual evaluation review of the technical compliance and effectiveness of Hong Kong’s anti-money laundering and counter-terrorist financing (AML/CFT) framework by the Financial Action Task Force (FATF), the international AML/CFT body.

Given the AML/CFT regulatory requirements and expectations on the Institute and the profession, after discussions with the government, we issued an alert in October 2018 to announce the introduction of an AML/ CFT monitoring programme within the Institute’s practice review system. This is an important development in our active participation in the AML/CFT regulatory regime. We also issued a questionnaire to all member practices to better understand their involvement in service areas that may be more vulnerable to money laundering or terrorist financing and to strengthen the Institute’s ability to conduct risk-based monitoring of compliance by members.

The Institute and representatives from member practices separately met the assessment team from the FATF in November 2018 as part of the review of Hong Kong’s AML regime. After the assessors’ visit to Hong Kong was completed, the Institute was invited to comment on relevant sections of the drafts of the mutual evaluation report. The final report was published in September 2019 and Hong Kong’s AML/ CFT regime was assessed to be compliant and effective overall, making it the first jurisdiction in the Asia-Pacific region to have achieved an overall compliant result.

Equipping members for the requirements

To assist member practices with their AML/CFT compliance, the Institute provided a range of services. In addition to an ongoing programme of seminars and workshops, to strengthen members’ practical knowledge of AML/CFT requirements and to promote good practice, we arranged a webcast by the author of the AML Procedures Manual for Accountants published in mid-2018 to help members navigate their way through the manual. The Institute continued to arrange favourable subscription rates for members with two market leaders in AML/CFT screening solutions: Thomson Reuters (now Refinitiv) and Dow Jones. The Institute’s AML webpage was strengthened by providing regular updates on United Nations sanctions and lists of terrorists.

“The QP emphasizes the full application of knowledge. It has greatly strengthened my problem-solving skills and helps me deal with the day-to-day challenges that come with being a CPA in this dynamic world,” says Chan.

ADVOCATING FOR THE BEST CORPORATE GOVERNANCE

The 19th edition of the Institute’s highly-respected Best Corporate Governance Awards reached a successful conclusion with the presentation ceremony held in November 2018 and the publication of the detailed judges’ report. The Permanent Secretary for Financial Services and the Treasury (Financial Services), Andrew Wong Ho-yuen, JP, was guest of honour at the awards presentation ceremony. A record total of 23 awards, special mentions and commendations across eight different categories were given out, including a number of awards for sustainability and social responsibility (SSR) reporting and the first ever award in the small market capitalization category for listed companies, which was set up in 2016. Around 700 annual and sustainability reports were initially examined to determine which listed companies and public sector/not-for-profit organizations merited a more in-depth review of their corporate governance or SSR reporting.

CAMPAIGNING FOR A MORE RESPONSIVE AND COMPETITIVE TAX SYSTEM

With regard to the 2019-20 government budget, the Institute submitted its tax policy and other budget proposals to the Financial Secretary. As well as the media activities responding to the budget (see Chapter 6 Communication and Engagement), a lively panel discussion was held in the evening of budget day. Kenneth Leung, the Legislative Council accountancy functional constituency representative, David Webb, Founder of webb-site.com, Professor Ho Lok Sang, Dean and Professor of Economics, Faculty of Business and Chu Hai College of Higher Education, KK So, the Taxation Faculty Executive Committee (TFEC) Chair, provided an analysis and commentary on the measures contained in the budget. The discussion was moderated by the Convenor of the Budget Proposals Subcommittee, Curtis Ng.

ADVOCATING FOR THE PROFESSION

The specialist faculties and other committees also met with various government bodies and contributed their expertise to a number of proposals across a range of areas.

Detailed minutes of last year’s annual meeting between representatives of the TFEC and the Commissioner and senior staff of the Inland Revenue Department were published on our website. The 2019 annual meeting was held in May and the record of discussions will be published.

The Institute’s Restructuring and Insolvency Faculty Executive Committee (RIFEC) completed the updating of Liquidation and Insolvency Guidance Notes (previously called the Insolvency Guidance Notes). The guidance aims to promote and encourage high standards in the insolvency profession, and the adoption of good practice by insolvency practitioners when carrying out professional work relating to liquidation and insolvency appointments.

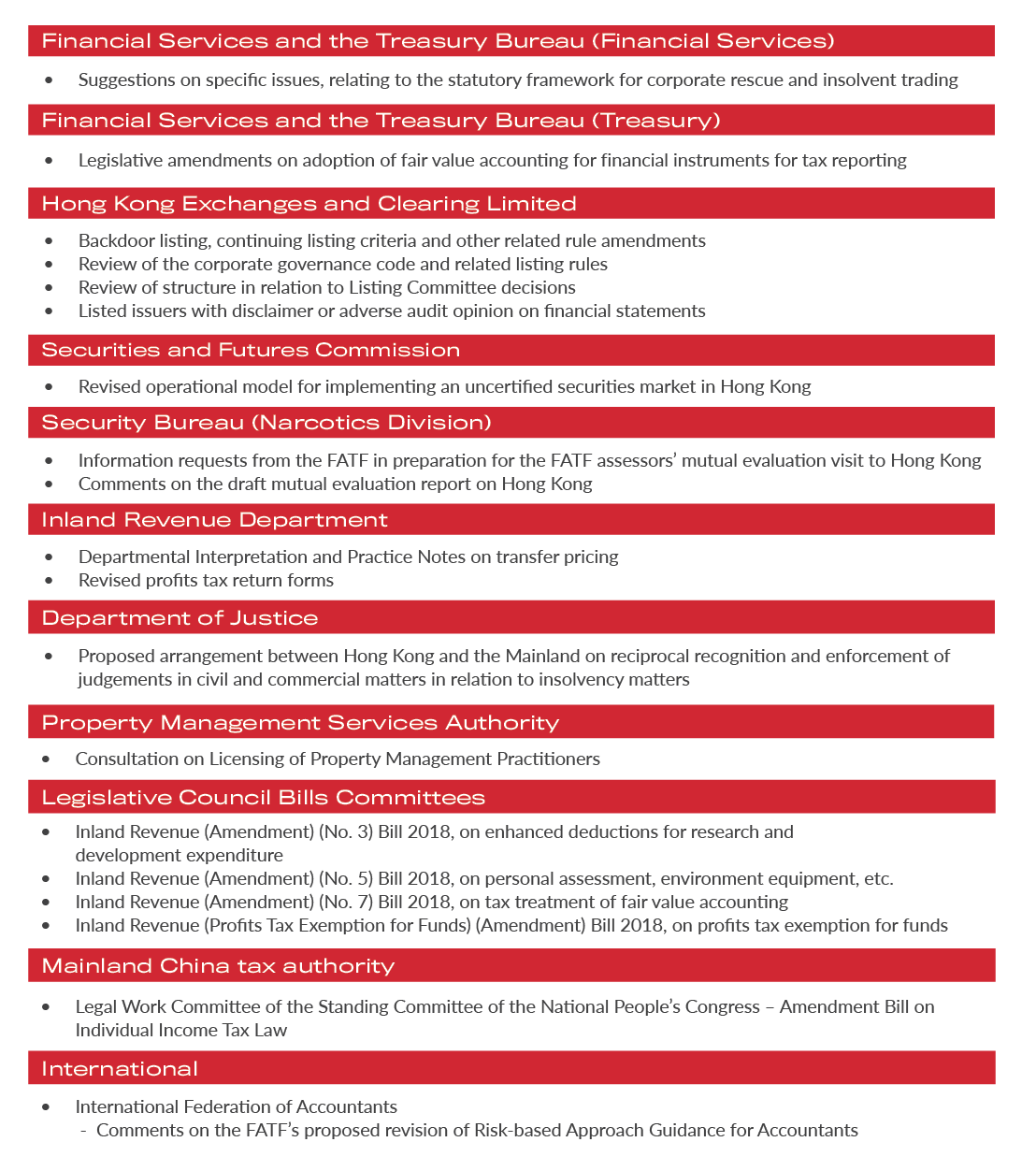

With the help of committees of experts, including the TFEC, the RIFEC and the Corporate Finance Advisory Panel, the Institute contributed its knowledge and expertise, and conveyed the views of the profession on a range of consultations and legislative proposals to different government departments and bureaux and other local and international bodies. Submissions included: